Investment Guide Dismoneyfied: Core Principles

1. Set Clear, Written Goals

Define your targets: “Retire at 60 with $1 million,” “Pay college for two kids in 10 years,” “Buy a house in five.” Assign a number and a deadline. Review these yearly—real life changes your priorities.

Without a goal, there’s no strategy—only confusion.

2. Build a Process for Automation

Set your paycheck or business to autotransfer a set amount monthly; treat investing as a nonnegotiable bill. Use roboadvisors or employer retirement plans for recurring deposits. Automate rebalancing if possible—discipline beats guessing when nerves are tested.

3. Diversification—Don’t Bet the House

Never go “all in” on a single stock, fund, or industry. Mix asset classes: stocks, bonds, real estate, and (if you understand them deeply) alternatives like private equity or crypto. Don’t overweight homecountry stocks—global diversification is a necessity.

The investment guide dismoneyfied is about resilience—protect against what you can’t predict.

4. Minimize Fees and Taxes

Prefer index funds and ETFs with low expense ratios (<0.2%)—compound returns are destroyed by fees. Use taxadvantaged accounts (401k, IRA, Roth) as your first funnel for new contributions. Harvest losses when available; delay gains strategically.

Every dollar you keep multiplies.

5. Avoid the Hype

Ignore “hot” tips from friends, social media, and clickbait headlines. Don’t chase performance—the best funds, stocks, and sectors change each year. Focus on process—steady buys, scheduled reviews, and routine rebalancing win over drama every time.

6. Emergency Fund Before Aggression

3–6 months of living expenses in a highyield savings account before investing anything risky. Never pull from this unless absolutely necessary—investing on borrowed time is suicide.

Security comes first.

7. Regular Review and Rebalancing

Quarterly or at least yearly, check your allocations: are you still on target? Did stocks overgrow? Is cash idling? Sell high, buy low—rebalancing is a forced system for avoiding fear and greed. Review individual asset performance and dump persistent underperformers only if your thesis broke, not just for a bad quarter.

8. Cut Losses and Let Winners Run

Don’t anchor to losing positions; admit errors and move funds to higherprobability ideas. Ride leaders, but don’t get greedy—set clear exit rules. Document your rationale for every trade; emotional decisions spiral quickly.

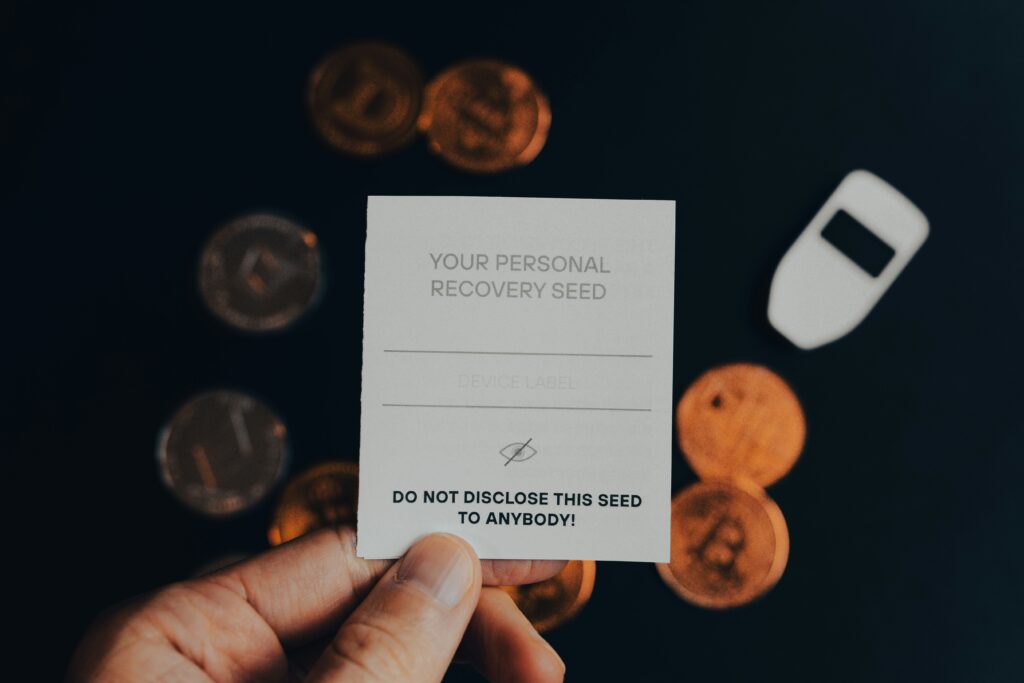

9. Security and Process Discipline

Use brokerages with SIPC (in the US), twofactor authentication, and a record of smooth withdrawals. Never give out account or tax info unless you initiated the call or login (watch for phishing). Keep a written log of all investments, usernames, and account rollovers—digital hygiene prevents disasters.

10. Rational Behavior > Technical Skill

Markets drop, rise, and flatten—successful investors stick to their scripts when everyone else panics. Ignore major moves during emotional spikes—only change allocations during calm, scheduled reviews. Don’t overtrade. Most mistakes happen during “itchy finger” moments.

Common Mistakes the Investment Guide Dismoneyfied Helps Dodge

Waiting to “feel ready”—time in the market beats timing the market. Overcomplicating with excessive asset types—keep it simple. Relying on prediction. Build strategies for a range of outcomes, not just one future.

LongTerm Routines

Audit every account for performance, fees, access, and beneficiary status yearly. Increase contribution rate every time you get a raise or new income. Keep a diary of returns, wins, losses, and “would have done” for honest selfeducation.

When to Get Help

Hire a fiduciary advisor for life events: marriage, divorce, inheritance, or business transition. Never use “advisor” services paid on commission, not performance. Consult an accountant at tax time for high six or sevenfigure portfolios.

Red Flags

Investment “guarantees” or “secret funds”—nothing is certain except fees and taxes. Strategies you don’t fully understand—if you can’t explain it in one paragraph, step back. Piling into speculative assets (crypto, options, IPOs) with rent or emergency funds.

Bottom Line

Longterm wealth is built with repeatable, reviewed, and automated action. The investment guide dismoneyfied is relentless: set goals, diversify, audit, and adjust without emotion. Beat the urge to jump ship during swings—discipline, not genius or luck, is what moves your future. Write out the plan, review your progress, and execute with relentless focus. In investing, boring is the winning strategy.